Table of Contents

- Introduction

- Understanding CBDCs:

- Features of the Digital Rupee

- Need for CBDCs

- Apps for the Digital Rupee

- How to Download and access the Digital Rupee?

- Challenges and Considerations

- Conclusion

Introduction

Central Bank Digital Currencies (CBDCs) have gained global attention as nations embrace digital transformations. In this context, India has made significant progress in developing its own CBDC known as the Digital Rupee. This article aims to delve into the concept, features, benefits, challenges, and the accompanying mobile apps available for the Digital Rupee CBDC.

Understanding CBDCs

CBDCs are digital representations of a country’s fiat currency issued and regulated by the central bank. Unlike cryptocurrencies, CBDCs are government-backed and aim to provide a digital version of physical cash, revolutionizing financial systems with efficiency, financial inclusion, and secure transactions.

Features of the Digital Rupee

The Digital Rupee aims to leverage technology to enhance India’s financial infrastructure and digitize its economy. Key features of the Digital Rupee CBDC include:

- Accessibility: The Digital Rupee ensures financial inclusion by providing access to all citizens, reducing reliance on physical cash.

- Security and Privacy: Robust security measures protect transactions while prioritizing user privacy and data protection.

- Real-time Settlements: Instantaneous transactions enable individuals and businesses to settle payments quickly and efficiently.

- Programmability: The Digital Rupee’s underlying technology enables programmable money, facilitating smart contracts and automated transactions.

Need for CBDCs

The need for CBDCs and the driving factors behind their development are listed below :

- Enhancing Financial Inclusion: One of the primary motivations for implementing a CBDC is to promote financial inclusion. By providing a digital form of fiat currency, CBDCs offer individuals who may not have access to traditional banking services the opportunity to participate in the formal financial system. This can empower the unbanked population, reduce financial inequalities, and foster economic growth.

- Efficiency and Cost Savings: CBDCs can significantly enhance the efficiency of financial transactions. Traditional payment systems often involve intermediaries, resulting in slower settlement times and higher costs. With CBDCs, transactions can be executed directly between parties, eliminating intermediaries and reducing processing times and associated fees. This increased efficiency can benefit both individuals and businesses, leading to cost savings and improved productivity.

- Strengthening Monetary Policy and Stability: CBDCs offer central banks enhanced control over monetary policy and economic stability. By having a digital currency, central banks can have a more granular understanding of money flows, enabling better assessment and management of macroeconomic factors such as inflation and deflation. CBDCs also provide a tool for implementing innovative monetary policies, such as negative interest rates, with more direct and immediate impact.

- Mitigating Risks of Cashless Economies: As digital payments become more prevalent, there is a growing concern over the risks associated with a fully cashless economy. CBDCs provide a digital alternative to physical cash, ensuring that individuals and businesses can continue to transact securely even in scenarios where digital infrastructure may be compromised. This helps maintain financial resilience and protects against potential disruptions in payment systems.

- Combatting Illicit Activities: The anonymity associated with cash transactions can facilitate illicit activities such as money laundering and tax evasion. CBDCs offer improved transparency and traceability, making it easier to monitor and prevent such activities. By integrating robust anti-money laundering measures, CBDCs can enhance the integrity of financial systems and contribute to global efforts in fighting financial crimes.

- Addressing Technological Advancements: Advancements in financial technologies, such as cryptocurrencies and digital payment platforms, have disrupted traditional financial systems. CBDCs allow central banks to leverage these technological advancements while maintaining regulatory control. By providing a secure and regulated digital currency, CBDCs can ensure the stability and reliability of national payment systems.

Apps for the Digital Rupee

The CBDC or the E-Rupee can be accessed with the help of the E-Rupee App of your specific Bank, Currently 11 Banks have been shortlisted by the Reserve Bank to Participate in this program i.e. SBI, Yes Bank, Kotak Mahindra Bank, ICICI Bank, Canara Bank, Axis Bank, IDFC First Bank, Union Bank of India, HDFC Bank & Bank of Baroda, Indus Ind Bank.

Do note that this is a pilot program and you can only access the app, if you have received the invite from your bank.

The download links of the apps for IOS/Android are listed below :

- SBI (Android): https://play.google.com/store/apps/details?id=org.npci.erupeeSBI&pli=1, SBI (IOS) : https://apps.apple.com/in/app/erupee-by-sbi/id1667077332

- Yes Bank(Android) : https://play.google.com/store/apps/details?id=org.npci.erupeeYES, Yes Bank (IOS) : https://apps.apple.com/in/app/yes-bank-digital-rupee/id1661773598

- Kotak Mahindra Bank (Android) : https://play.google.com/store/apps/details?id=org.npci.erupeeKOTAK, Kotak Mahindra Bank (IOS) : https://apps.apple.com/in/app/digital-rupee-by-kotak-bank/id6447517281

- ICICI Bank (Android) : https://play.google.com/store/apps/details?id=com.icici.digitalrupee, ICICI Bank (IOS) : https://apps.apple.com/in/app/digital-rupee-by-icici-bank/id1671229934

- Canara Bank (Android) : https://play.google.com/store/apps/details?id=org.npci.erupeeCANARA, Canara Bank (IOS) : https://apps.apple.com/in/app/canara-digital-rupee/id6447098968

- Axis Bank (Android) : https://play.google.com/store/apps/details?id=com.axisbank.cbdc, Axis Bank (IOS) : https://apps.apple.com/in/app/axis-mobile-digital-rupee/id6448527099

- IDFC First Bank (Android) : https://play.google.com/store/apps/details?id=org.npci.erupeeIDFC, IDFC First Bank (IOS) : https://apps.apple.com/in/app/idfc-first-bank-digital-rupee/id1666274203

- Union Bank Of India (Android) : https://play.google.com/store/apps/details?id=org.npci.erupeeUBI, Union Bank Of India (IOS) : https://apps.apple.com/in/app/ubi-digital-rupee/id6446883723

- HDFC Bank (Android) : https://play.google.com/store/apps/details?id=org.npci.token.hdfc

- Bank of Baroda (Android) : https://play.google.com/store/apps/details?id=org.npci.token.bob, Bank of Baroda (IOS) : https://apps.apple.com/in/app/bank-of-baroda-digital-rupee/id6445941213

- Indus Ind Bank (Android) : https://play.google.com/store/apps/details?id=in.sarvatra.erupeeINDUSIND, Indus Ind Bank (IOS) : https://apps.apple.com/in/app/digital-rupee-by-indusind-bank/id1670622253

How to Download and access the Digital Rupee?

The below walkthrough video of the Digital Rupee by ICICI Bank gives a brief explanation on the process :

More information can be found here : https://www.icicibank.com/blogs/internet-banking/5-w-s-of-digital-rupee-india-s-cbdc

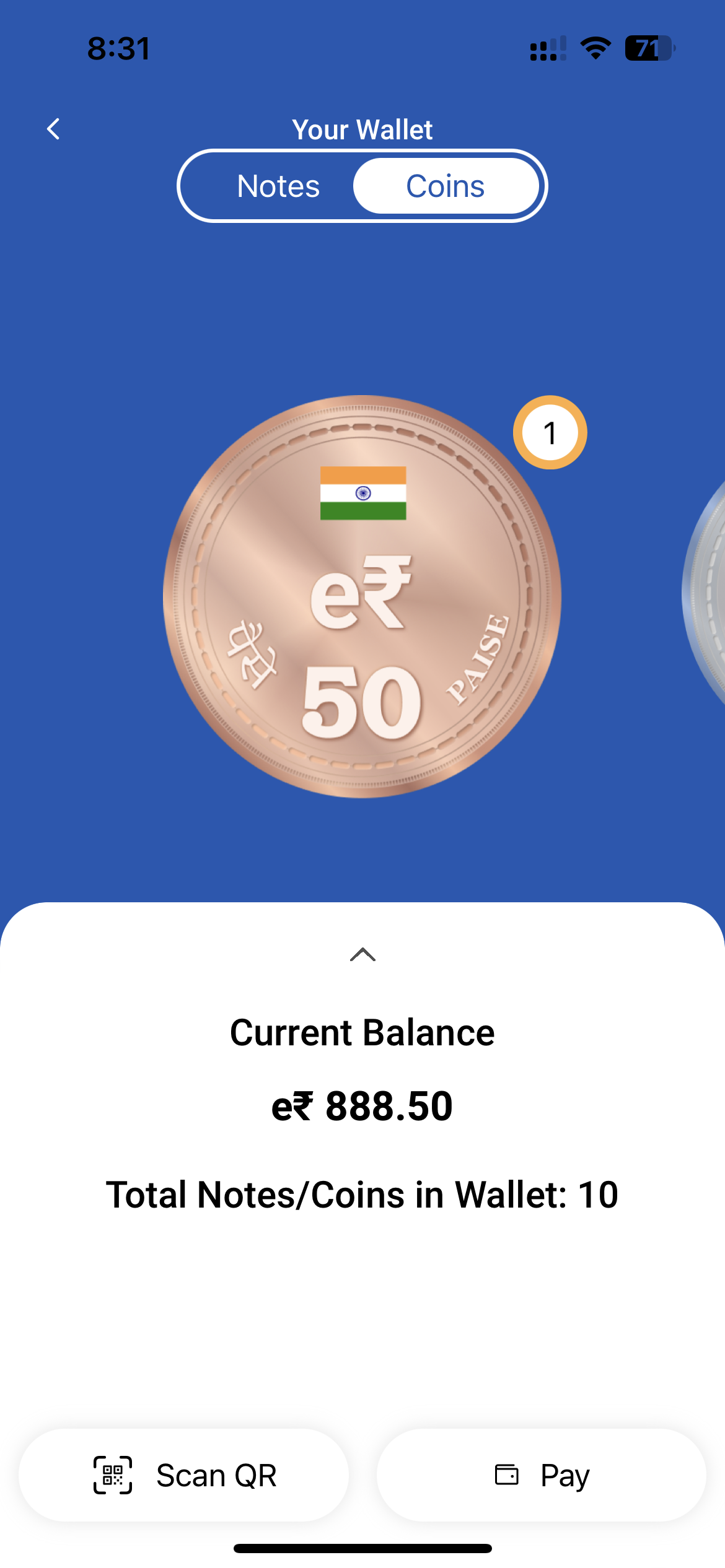

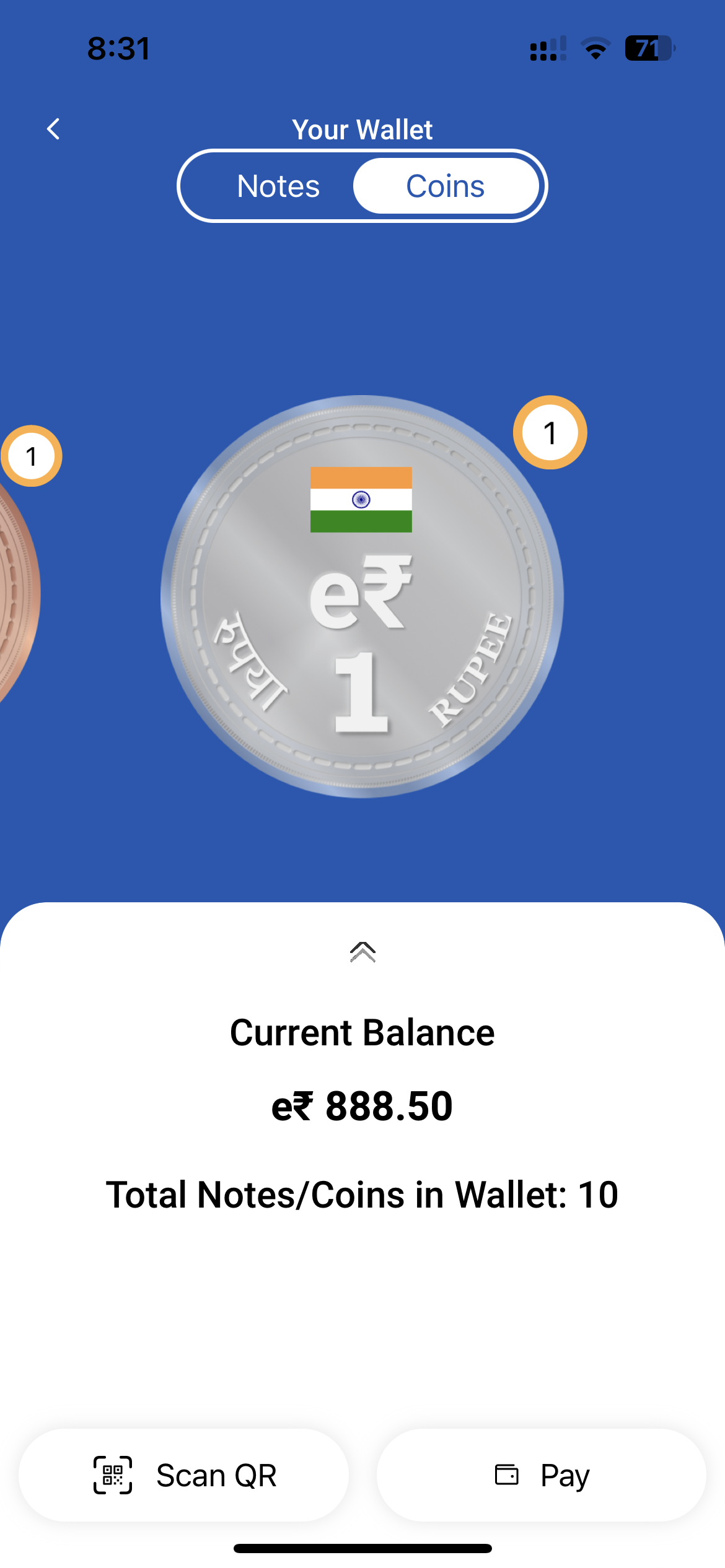

The Screenshots of the various denominations of the Currencies is also attached below for reference, each virtual currency is assigned a unique serial number like we can find on the physical notes.

Challenges and Considerations

While the Digital Rupee holds immense promise, its implementation poses challenges that need to be addressed:

- Technological Infrastructure: Establishing a robust and secure infrastructure capable of handling the demands of a national CBDC.

- User Adoption: Educating and raising awareness among a diverse population to encourage widespread Digital Rupee adoption.

- Cybersecurity Risks: Strengthening the Digital Rupee against cyber threats to protect user funds and prevent unauthorized access.

- Regulatory Framework: Developing comprehensive regulations to integrate the Digital Rupee into existing financial systems and address potential risks.

Conclusion

India’s Digital Rupee CBDC marks a significant milestone in the country’s journey towards a digital economy. By leveraging technology for financial inclusion, efficiency, and security, the Digital Rupee has the potential to revolutionize India’s financial landscape. With dedicated mobile apps and digital platforms, individuals and businesses can seamlessly embrace the Digital Rupee, enabling faster transactions and a robust digital payment ecosystem. Overcoming challenges through careful planning, collaboration, and stakeholder engagement will pave the way for successful implementation, allowing India to embrace the benefits of a digital currency tailored to its unique needs.