Beware of Fake Call Centers: How Scammers Are Stealing Money Using Big Brand Names

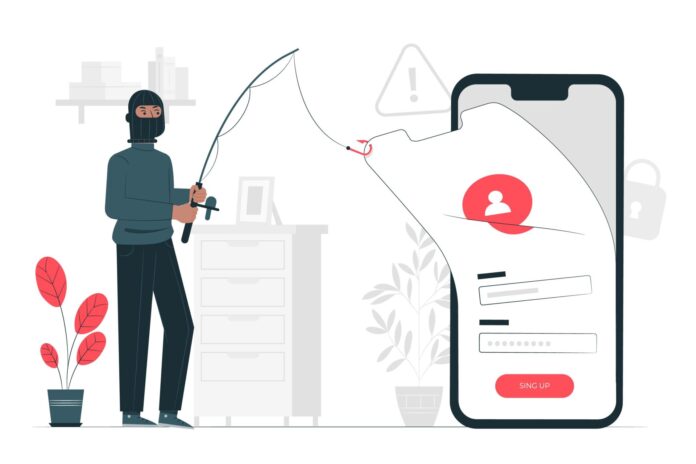

In recent years, there has been a surge in fake call centers operating predominantly in the eastern corridor of India. These fraudulent operations target individuals outside the country, using deceptive emails and notifications to trick unsuspecting victims. Here’s how these scams work and what you need to know to protect yourself.

The Motive Behind Fake Call Centers

The primary aim of these scams is to steal people’s hard-earned money through social engineering and fake communications. The scammers often impersonate well-known brands such as Microsoft, Apple, Norton, McAfee, and Google by using their logos and templates in phishing emails.

How Do These Scams Work?

The process typically involves several carefully orchestrated steps:

1. Fake Emails

Victims receive an email claiming that a charge has been made to their credit card for a subscription. The email appears legitimate, using logos and branding of well-known companies. Sometimes, the email includes an attachment with a fake invoice or letter.

💡 Pro Tip: There’s no actual charge on your card—this is a trick to grab your attention.

2. Fake Customer Care Numbers

The email urges victims to call a customer care number to resolve the issue. These numbers often appear in search results, masquerading as genuine support contacts.

3. Remote Access Requests

Once the victim calls, a scammer posing as a customer service agent engages them in conversation and asks them to install remote control software like TeamViewer or AnyDesk.

⚠️ Note: These programs are legitimate but should only be used with trusted individuals.

4. Fake Refund Simulation

The scammer pretends to process a refund, showing the victim a fake banking page. They simulate an overpayment, making it appear that the victim received more money than they were owed.

5. Cash Withdrawal

The victim is convinced to withdraw the “extra” amount in cash from their bank account.

6. Bitcoin ATM Deposits

The scammer instructs the victim to deposit the cash into a Bitcoin ATM.

7. Online Banking Fraud

In cases where the victim has online banking, the scammer persuades them to buy Bitcoin and transfer it to the scammer’s wallet. Since Bitcoin transactions are unregulated and untraceable, recovering the money is nearly impossible.

8. Credit Card Information Theft

In some instances, scammers trick victims into filling out forms with their credit card details, allowing them to debit arbitrary amounts.

Key Takeaways to Stay Safe

- Verify Emails: Always double-check the sender’s email address and be wary of unexpected emails claiming charges or subscriptions.

- Avoid Calling Numbers in Emails: Search for the official customer service number on the brand’s official website.

- Be Cautious with Remote Access: Never install remote control software at the request of someone you don’t know or trust.

- Know Bitcoin Risks: Avoid transferring money to Bitcoin wallets without thorough verification.

Final Word

Fake call centers are becoming increasingly sophisticated in their tactics. By staying informed and cautious, you can protect yourself and your loved ones from falling victim to these scams. Share this information widely to raise awareness and help combat these fraudulent operations.

Stay safe and vigilant!